The silver price is rallying dramatically at the moment. This is because the price has finally broken out of a 13 year correction it is has been stuck in since 2011 after being dragged up by a very strong gold price. The gold/silver ratio is in the high 80's which suggests this rally is only just getting started...

Over the last few weeks gold has broken above the green resistance line which goes back all the way to 2011. The line has been tested several times. The most recent breakout is currently being back tested. One more weekly close above the green line and the new gold bull market has begun.

Short term resistance has been met and the Nasdaq has just recently broken through its short term support. This would indicate to me a correction will follow taking the price of the Nasdaq back down to medium term support. After this i would exercise caution, any short term bounce may be followed by another breakdown in the medium term support. Then the Nasdaq...

The Cameco stock price has broken out on the monthly candlestick. This is as good as it gets for a bullish indication. The future is Uranium and it appears the investing world knows this. The red resistance line goes back as far as 2007, so any moves following this breakout are likely to be significant. Buy near this breakout level, but not much higher.

Crude oil has broken out from a multi-year logarithmic descending channel. Following the start of the Ukraine war, and the breakout in oil price it has since tested the upper channel resistance line, confirmed now as support. More recently the crude oil price has broken out of its short term descending resistance line and appears to have created a short term...

The gold and silver price remains trapped between support and resistance lines. A break above or below the green or red lines would signify the proposed moves for years to come. Wait for the break of the respective support or resistance lines before making any bets. However it is important to note, both gold and silver have had false breakdowns, which is a...

Bitcoin has just completed a false breakout. One of the most bearish signals in technical analysis. I would expect much more pain in the crypto markets going forward as a result.

Gold will have some weakness in the coming weeks, however it should find support around $1830/oz. I would imagine the price will hover around this area for another couple of months, until a final breakout towards the end of the year. The false breakdown we have just witnessed is incredibly bullish and therefore I am extremely long.

Every time the short term support line is broken the FTSE100 index has always reverted down to the red long term support trendline. Therefore, it is sensible to assume that this will be the case again. A buy target of 5000-5500 is reasonable, however if the index drops below 5000, all bets are off.

Even on the log chart, the trendline for the bullish trend is being broken. This is incredibly bearish. If the bitcoin price doesn't bounce here, i'd expect the price to head much lower.

If the Nasdaq is correcting into a bear market, so will the Crypto space.

Now we must see a bounce off of the red supporting trendline (was previously resistance), otherwise the silver bull market is off.

The rotation out of stocks into gold has begun. Get yours before there's none left.

Based on the Fed's adamant nature on raising rates over the next two meetings, I see weakness in the silver price. But not much more. I think the Fed pauses and possibly pivots to easing after August when the true nature of the coming recession reveals itself. Following that I see a rapid rise in the price of silver, in a similar time frame between 2008 and...

After completing the arc pattern, I would expect gold to hit $2500/oz by late 2022. The rise will match the depth of the downturn we have seen in the arc.

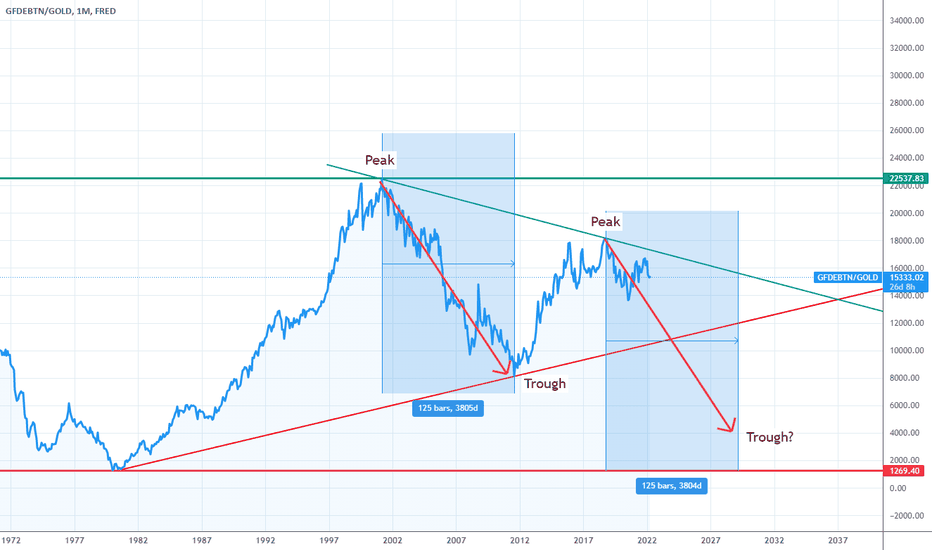

The US debt to Gold ratio looks to be topping. The lower this ratio, the more US debt is covered by gold and generally means a rally in the price of gold. When this ratio breaks the minor diagonal support line, the major support line will be the next target and gold will see gains not seen since the late 1970's.

Provided the Ukraine crisis doesnt boil over into a hot war, the price of UK natural gas should stabilise. The price of natural gas will still be much higher than in 2020, however it should lead to more reasonable energy prices for the UK, again subject to de-escalation of the Ukraine crisis.

During periods of deep negative real rates gold tends to do very well. The 1970's was a decade which saw big moves in real rates due as the Fed trying to combat the high inflation. The more volatile the moves are in real rates, and the deeper into negative territory real rates go, the better gold performs. We may be entering a similar period where the Fed is...