Next report date

Report period

H1 2024

EPS estimate

—

Revenue estimate

—

0.10GBP

349.00 MGBP

3.51 BGBP

3.47 B

About TAYLOR WIMPEY PLC ORD GBP0.01

Sector

Industry

CEO

Jennie Daly

Website

Headquarters

High Wycombe

Founded

1880

ISIN

GB0008782301

FIGI

BBG000BF4KL1

Taylor Wimpey Plc operates as a residential developer. It engages in land acquisition, home and community design, urban regeneration and the development of supporting infrastructure. It operates through the United Kingdom and Housing Spain segments. The United Kingdom Housing segment builds houses in the UK, from one bedroom apartments to five bedroom houses. The Housing Spain segment builds homes in popular locations that appeal to both foreign and Spanish buyers. The company was founded in 1880 and is headquartered in High Wycombe, the United Kingdom.

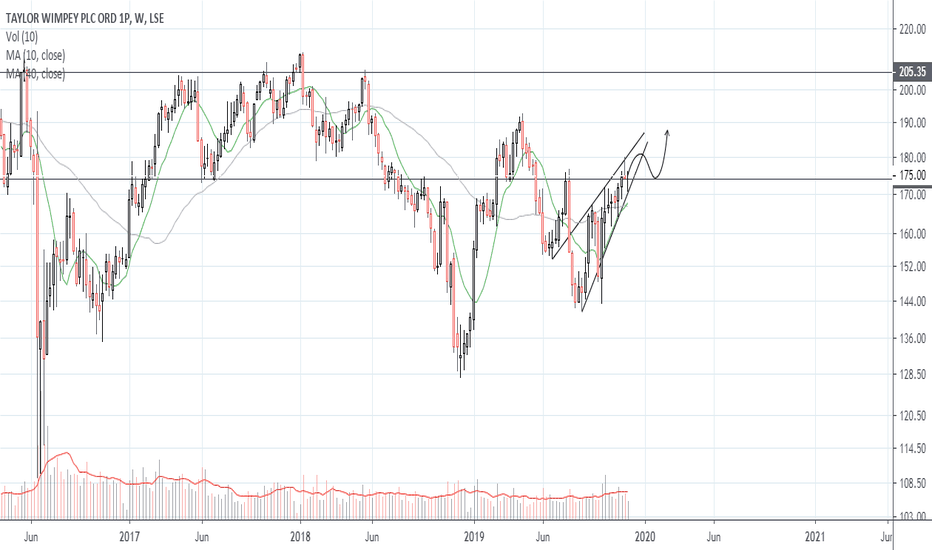

Taylor Wimpey PlcUK home-builder and development space looking interesting at current (technical) levels (also see Barratt Developments - BDEV).

TW at lower range of linear regression channel as well as testing prior breakout/supply area (now potentially support).

Not sure if going trade lower in the next few da

Taylor Wimpey TW *GOOD LONG TERM BUYING OPPORTUNITY*Taylor Wimpey Analysis.

Currently trading at more than a 54% discount from the current yearly highs and price is sat around 109/110 support zone. This price level was the very bottom of the lows seen during the 2016 sell-off.

They have a strong dividend yield history paying over 9% and before cov

Taylor Wimpey Stock Price Potentially Can Re-Test Its Swing HighWeekly just made a new high before the stock price fall to test support level @ 193.05. Potentially, TW can re-test the swing high at 237.10, however, further decline below 185 is more desirable before buying the stock.

N.B

- Let emotions and sentiments work for you

-ALWAYS Use Proper Risk Manageme

See all ideas

Trade directly on the supercharts through our supported, fully-verified and user-reviewed brokers.

Frequently Asked Questions

The current price of TW. is 134.30 GBX — it has increased by 2.17% in the past 24 hours.

Depending on the exchange, the stock ticker may vary. For instance, on LSE exchange TAYLOR WIMPEY PLC ORD GBP0.01 stocks are traded under the ticker TW..

TAYLOR WIMPEY PLC ORD GBP0.01 is going to release the next earnings report on Jul 31, 2024. Keep track of upcoming events with our Earnings Calendar.

TW. stock is 2.77% volatile and has beta coefficient of 1.42. Check out the list of the most volatile stocks — is TAYLOR WIMPEY PLC ORD GBP0.01 there?

TW. earnings for the last quarter are 0.09 GBX per share, whereas the estimation was 0.06 GBX resulting in a 55.41% surprise. The estimated earnings for the next quarter are 0.07 GBX per share. See more details about TAYLOR WIMPEY PLC ORD GBP0.01 earnings.

TAYLOR WIMPEY PLC ORD GBP0.01 revenue for the last quarter amounts to 2.20 B GBX despite the estimated figure of 1.98 B GBX. In the next quarter revenue is expected to reach 2.08 B GBX.

Yes, you can track TAYLOR WIMPEY PLC ORD GBP0.01 financials in yearly and quarterly reports right on TradingView.

TW. stock has risen by 2.83% compared to the previous week, the month change is a 4.51% fall, over the last year TAYLOR WIMPEY PLC ORD GBP0.01 has showed a 7.27% increase.

TW. net income for the last quarter is 173.30 M GBP, while the quarter before that showed 175.70 M GBP of net income which accounts for −1.37% change. Track more TAYLOR WIMPEY PLC ORD GBP0.01 financial stats to get the full picture.

Today TAYLOR WIMPEY PLC ORD GBP0.01 has the market capitalization of 4.75 B, it has increased by 0.27% over the last week.

TAYLOR WIMPEY PLC ORD GBP0.01 dividend yield was 6.51% in 2023, and payout ratio reached 96.87%. The year before the numbers were 9.25% and 52.08% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

Like other stocks, TW. shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade TAYLOR WIMPEY PLC ORD GBP0.01 stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So TAYLOR WIMPEY PLC ORD GBP0.01 technincal analysis shows the neutral today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating TAYLOR WIMPEY PLC ORD GBP0.01 stock shows the buy signal. See more of TAYLOR WIMPEY PLC ORD GBP0.01 technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.

We've gathered analysts' opinions on TAYLOR WIMPEY PLC ORD GBP0.01 future price: according to them, TW. price has a max estimate of 175.00 GBX and a min estimate of 130.00 GBX. Read a more detailed TAYLOR WIMPEY PLC ORD GBP0.01 forecast: see what analysts think of TAYLOR WIMPEY PLC ORD GBP0.01 and suggest that you do with its stocks.

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. TAYLOR WIMPEY PLC ORD GBP0.01 EBITDA is 496.50 M GBP, and current EBITDA margin is 14.30%. See more stats in TAYLOR WIMPEY PLC ORD GBP0.01 financial statements.