Energy stocks and ETF will continue to rallyIF you for some reasons are lost and confused finding the right Energy companies to buy, then a global Energy ETF might be suitable. It saves you the hassle of scrutinising the financial performance of the companies and allows you a bigger birds eye view of the global market.

Key stats

About ISHARES GLOBAL ENERGY ETF

Expense ratio

0.44%

Home page

Inception date

Nov 12, 2001

IXC fits the bill if youre looking for neutral exposure to the global energy sector. The fund starts off with an underlying index that a committee narrows down to include companies reflective of the broad energy sector. And even though it proportionally weights issuers by market-cap, its large-cap bias introduces a few overweights in the fund, and a heavy investment in a few US giants (but that's inherent to the sector). Overall, it is imperative to note certain concentration risks before investing in this fund. Holdings are market cap-weighted, subject to capping, which limits single security weights to 22.5% and the aggregate of all securities by an issuer exceeding 4.5% to be capped at 45%. The index is rebalanced quarterly in March, June, September, and December. Prior to Mar. 20, 2023, the IXC tracked S&P Global 1200 Energy Index.

Classification

What's in the fund

Exposure type

Energy Minerals

Industrial Services

Stock breakdown by region

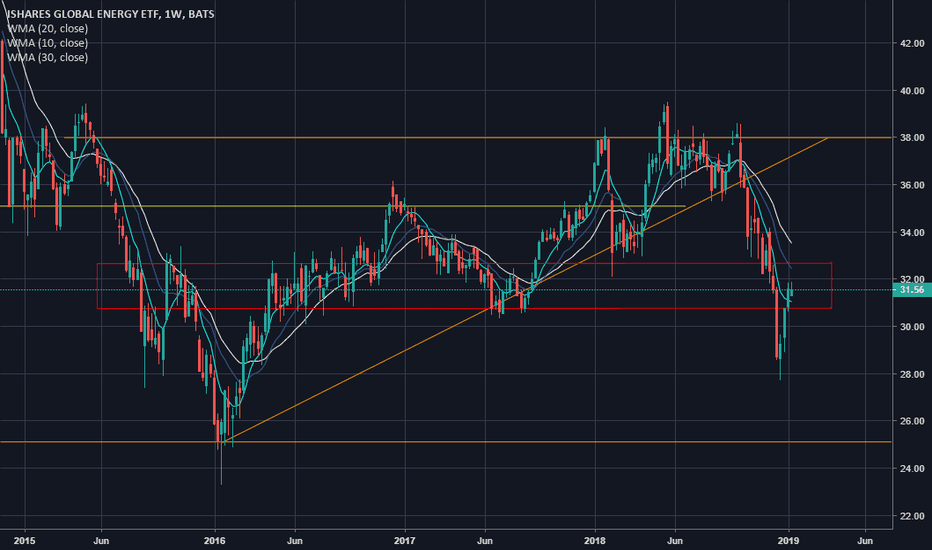

[ENERGY ETF] AWAITING BREAKOUTThis ETF has been falling constantly on the weekly chart as it is waiting for its exhaustion stage to retest the 20 or 30 Day WMA. It could possibly reverse all together and starting its bull trend relative to the volume. For the last week or so it has been trapped and seem to be consolidating. I ha

[TRAPPING THE PRICE] *ENERGY ETF*Finding different weekly support and resistance levels dating back to 2008. I am marking levels that have confirmed the price getting caught in, then when breaking either up or down it will continue that way for a short period of time. Next I will show a daily projection based off of the levels I ha

See all ideas