Indicators, Strategies and Libraries

█ This Indicator is based on Pivot detection to show bands and channels. The pivot price is similar to a resistance or support level. If the pivot level is breached, the price should continue in that direction. Or the price could reverse at or near this level. █ Usages: Use channels as a support & resistance zone. Use bands as a support & resistance zone....

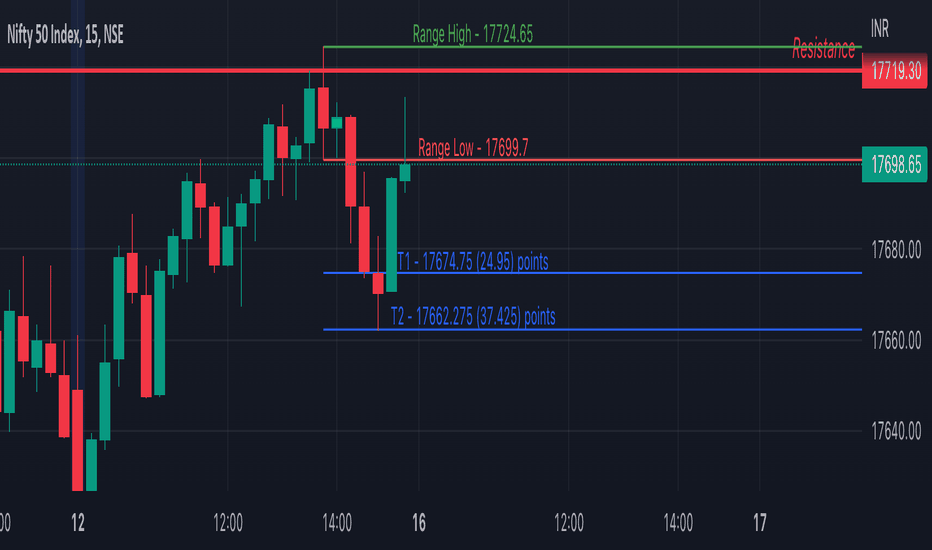

Script Details - This script plots Inside Bar for given day in selected time-frame (applicable only for Timeframes < Day) - Basis plotted inside bar, relevant targets are marked on the chart - Targets can be customised from script settings. Example, if range of mother candle is 10 points, then T1 is 10 * x above/below mother candle and T2 is 10 * y above/below...

The RedK Chop & Breakout Scout (C&BS or just CBS) is a centered oscillator that helps traders identify when the price is in a chop zone, where it's recommended to avoid trading or exit existing trades - and helps identify (good & tradeable) price breakouts. i receive many questions asking for simple ways to identify chops .. Here's one way we can do that. (This...

-Modified version of Squeeze Momentum Indicator by @LazyBear. -Converted to version 5, -Taken inspiration from @KivancOzbilgic for its buy sell calculations, -Used @Bunghole strategy template with Take Profit, Stop Loss and Enable/Disable Toggles -Added Custom Date Backtesting...

█ Overview Breakout Probability is a valuable indicator that calculates the probability of a new high or low and displays it as a level with its percentage. The probability of a new high and low is backtested, and the results are shown in a table— a simple way to understand the next candle's likelihood of a new high or low. In addition, the indicator displays...

Qullamaggie Daily This Indicator is a Combination of Moving Averages (Simple and Exponential) as definied from Qullamaggie and used in his TC2000 Setup Moving Averages: - The Moving Averages are Guidelines for the current Trend and are not decive for the Entry - They shall be a quick view and visual assistance to find strong momentum stock that are currently...

Hi Traders, I've developed an indicator which can detect fake-breaks on the chart. In the following you'll find the definition of the fake break candles and also you will find how to recognize it on the chart with practical examples. What is the fake break pattern? Sometimes support and resistance lines broke with a full body and strong candles that gives us...

This is a 1 trade per day strategy for trading SPY or QQQ index. By default, this is designed for 1 min time frame. This was an experimental script that seems to be profitable at the time of publication. How it works: Pre-market high and low is defined per trading day between 9:00 to 9:30 EST. Then we looking for the first breakout on either PM high or PM...

Name: TheBigBangTraders Breakout Category: Trend Follower Operating mode: Spot Trades duration: Intraday Timeframe: 1H Suggested usage: the purpose of this strategy is to help to investigate if the asset is sensitive to breakout approach. Entry: Trigger point can be choose by the user between: High of the N days ago High of the N weeks...

The Bollinger Bands Breakout Oscillator is an oscillator returning two series quantifying the significance of breakouts between the price and the extremities of the Bollinger Bands indicator. Settings Length: Period of the Bollinger Bands indicator Mult: Controls the width of the Bollinger Bands Src: Input source of the indicator Usage Each...

If you struggle with the entries, low % win rate or trading the squeeze setup overall, this indicator is for you! If you look closely at your losing trades, chances are the losers have one thing in common = inverse momentum. I created this tool after I found out that Stacked EMAs and picture perfect trend is not the only thing you need for a squeeze setup....

If you want to be alerted when a price closes above or below a given level(s), then this indicator is for you! 😁 Whether you're looking for a breakout, or some change of structure, etc, this should come in handy. Usage: Just add a level(s) (anything above 0). Optionally plot lines. Set alerts as normal. Enjoy!

green is long target white is sl red is short target white is sl

Custom swing fail detector with levels and breakouts both major and minor plus colored candles based on SFP momentum.

Match with the MM Chop Filter This draw Non repainting range boxes when the oscillator see a range. -Breakout Buy/Sell Signals and Exit signals when prices enters a range just in case you did get into a trade. . -Alarms to match the signals How to use Match with the oscillator and always trade the trend with your strategy confirmation and the breakout this...

Based On the "Chop and explode Indicator by fhenry0331 We Updated to Pine 5 - Added break out alerts and Signals -Customize thresholds How To use when the line is blue confirmed Buy Line is Red confirmed Sell ALWAYS use in confirmation with your strategy and Trade with the trend. Match with the on chart version for best results

Built with love "Smarter SNR (Support and Ressistance, Trendline, MTF OSC) " This indiator will show you Support & Ressistance, Good Trendline, and Multi-timeframe analyzing of Oscillator (Stochastic and RSI) You can combine with your own strategy, or use this purely DISCLAIMER : Measure the risk first before use it in real market Backtest The Strategy was very...

This is a strategy used by Larry R. Williams called Volatility Breakout. By identifying a strong uptrend that exceeds 'a certain level' on a daily basis as a breakout signal, enter long position, take advantage of long at the the next day's open. 'a certain level (Entry Price)' is calculated by { close + 'k' * high -low }, and applied logarithmic...

![Pivot-Based Channels & Bands [Misu] BTCUSDT: Pivot-Based Channels & Bands [Misu]](https://s3.tradingview.com/x/XQOZbYrE_mid.png)

![Squeeze Momentum Strategy [LazyBear] Buy Sell TP SL Alerts BTCUSDT: Squeeze Momentum Strategy [LazyBear] Buy Sell TP SL Alerts](https://s3.tradingview.com/l/lEQZl0vE_mid.png)

![[Pt] Premarket Breakout Strategy SPY: [Pt] Premarket Breakout Strategy](https://s3.tradingview.com/0/0LJUxO7T_mid.png)

![Bollinger Bands Breakout Oscillator [LuxAlgo] BTCUSD: Bollinger Bands Breakout Oscillator [LuxAlgo]](https://s3.tradingview.com/y/YaniRMVC_mid.png)