UKX trade ideas

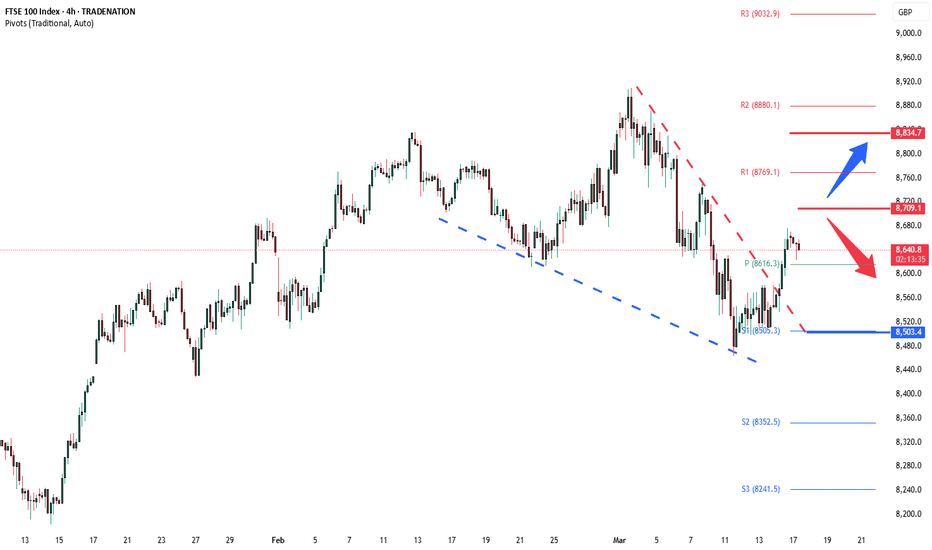

FTSE INTRADAY Bullish breakoutThe FTSE 100 index is currently exhibiting a neutral sentiment, as evidenced by the prevailing sideways consolidation. The primary focus remains on the key resistance level at 8700, which corresponds to the current intraday swing high. This level is critical as it determines the next directional move of the index.

From the current levels, an oversold rally could potentially emerge, leading to a retest of the 8700 resistance. A bearish rejection from this level would reinforce the downtrend, paving the way for a move towards the 8500 support. Further downside momentum could extend losses to the next support levels at 8440 and 8352 over a longer timeframe.

On the other hand, a confirmed breakout above 8700 on a daily closing basis would invalidate the bearish outlook. In such a scenario, the index is likely to experience renewed buying interest, targeting the next resistance at 8770, followed by a potential rally towards the 8834 level.

Conclusion:

The overall sentiment for the FTSE 100 remains bearish unless a decisive breakout above the 8700 resistance occurs. Traders should monitor price action around this critical level for confirmation of either a continuation of the downtrend or a potential bullish reversal.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

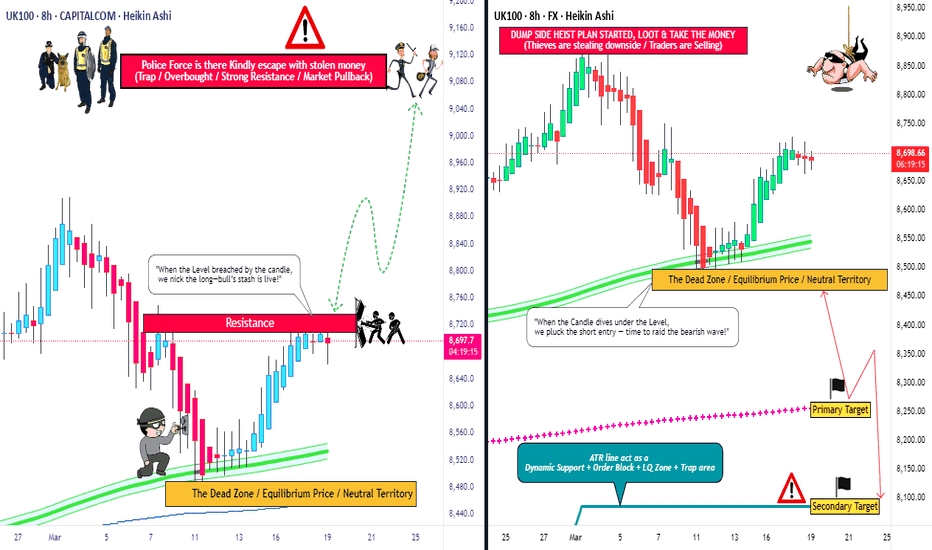

UK100 "FTSE 100 INDEX CASH" Heist Plan (Swing Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the UK100 "FTSE 100 INDEX CASH" market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry and short entry. 🏆💸"Take profit and treat yourself, traders. You deserve it!"💪🏆🎉

Entry 📈 :

"The loot's within reach! Wait for the breakout, then grab your share - whether you're a Bullish thief or a Bearish bandit!"

🏁Buy entry above 8760

🏁Sell Entry below 8450

📌However, I recommended to place buy stop for bullish side and sell stop for bearish side.

Stop Loss 🛑:

🚩Thief SL placed at 8600 (swing Trade Basis) for Bullish Trade

🚩Thief SL placed at 8700 (swing Trade Basis) for Bearish Trade

Using the 4H period, the recent / swing low or high level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯:

🏴☠️Bullish Robbers : TP 9080 (or) Escape Before the Target

🏴☠️Bearish Robbers : Primary TP - 8250 (&) Secondary TP - 8100 (or) Escape Before the Target

UK100 "FTSE 100 INDEX CASH" Market Heist Plan is currently experiencing a neutral trend,., driven by several key factors.

📰🗞️Get & Read the Fundamental, Macro, COT Report, Geopolitical and News Analysis, Sentimental Outlook, Intermarket Analysis, Index-Specific Analysis, Positioning and future trend targets.. go ahead to check 👉👉👉

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

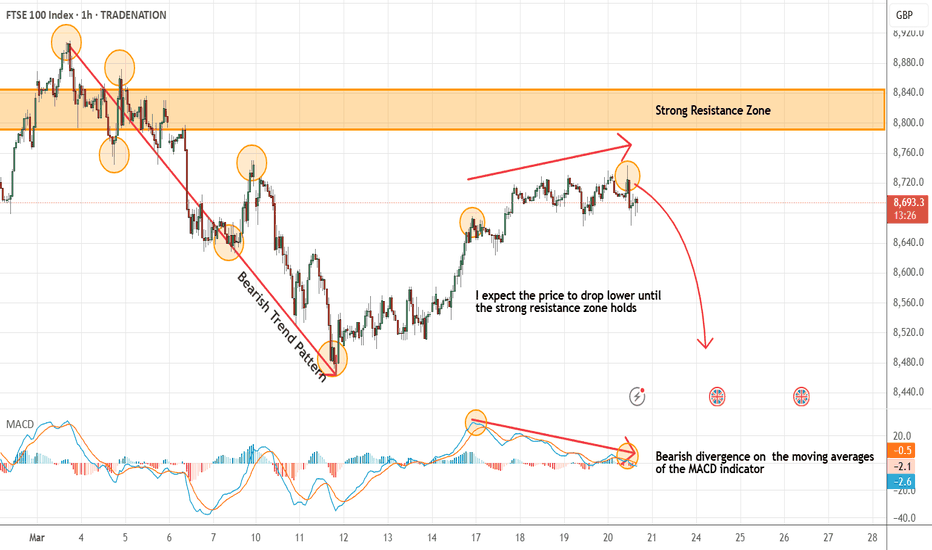

UK100 - Expecting The Price To Drop Lower FurtherHi Traders, on March 11th I shared this "UK100 - Looking To Sell Pullbacks In The Short Term"

We expected to see correction prior to the bearish continuation. You can read the full post using the link above.

Price is moving as per the plan!!!

Based on the current scenario my bearish view still remains the same here.

We have bearish divergence in play based on the moving averages of the MACD and I expect the price to drop lower further until the strong resistance zone holds

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

---------------------------------------------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

FTSE100 INTRADAY , previous support - new resistance at 8760The FTSE equity index currently shows a bearish sentiment, driven by the breakdown of the long-term prevailing uptrend. The recent oversold bounceback is attempting to retest major resistance at 8760, which marks the intraday swing high and aligns with the falling resistance trendline.

Key Support and Resistance Levels

Resistance Level 1: 8760 (intraday swing high and falling trendline resistance)

Resistance Level 2: 8837

Resistance Level 3: 8900

Support Level 1: 8565

Support Level 2: 8476

Support Level 3: 8327

Bearish Scenario

If the oversold rally is met with a bearish rejection at the 8760 resistance level, it would reaffirm the bearish outlook. This could trigger a decline targeting the 8565 support level, followed by further downside movement toward 8476 and 8327 over the longer timeframe.

Bullish Scenario

Alternatively, a confirmed breakout above 8760 resistance and a daily close above this level would invalidate the bearish bias. This scenario could set the stage for further rallies, with potential upside targets at 8837 and ultimately 8900.

Conclusion

The FTSE index exhibits a bearish continuation setup, with the 8760 resistance level being crucial. A rejection at this level could prompt a renewed move lower, while a breakout would signal bullish momentum and open the way for further gains. Traders should watch for decisive price action around 8760 to determine the next directional bias.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

Bullish bounce?UK100 has bounced off the pivot and could rise to the 1st resistance.

Pivot; 8,460.55

1st Support: 8,314.59

1st Resistance; 8,913.87

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

"UK100 / FTSE100" Indices Market Bullish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Thieves, 🤑 💰🐱👤🐱🏍

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "UK100 / FTSE100" Indices Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Book Profits, Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (8850.00) then make your move - Bullish profits await!"

however I advise to placing the Buy Stop Orders above the breakout MA or placing the Buy limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

Stop Loss 🛑: Thief SL placed at 8720.00 (swing Trade Basis) Using the 4H period, the recent / Swing Low or High level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 9150.00 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT, Sentimental Outlook:

"UK100 / FTSE100" Indices Market is currently experiencing a bullish trend,., driven by several key factors.

🟤Market Overview

Current Price: 8740.00

30-Day High: 8920.00

30-Day Low: 8450.00

30-Day Average: 8630.00

🔵Fundamental Analysis

Economic Trends: The UK economy is expected to grow, driven by a rebound in consumer spending and investment

Interest Rates: The Bank of England is expected to maintain low interest rates, supporting the UK stock market

🟢Macro Economics

Global Economic Trends: The ongoing global economic recovery is expected to drive up demand for UK exports

Inflation Rate: Global inflation is expected to rise to 3.8% in 2025, potentially increasing demand for UK goods and services

Interest Rates: Central banks are expected to maintain low interest rates in 2025, supporting stock markets

🟡COT Data

Non-Commercial Traders (Institutional):

Net Long Positions: 52%

Open Interest: 120,000 contracts

Commercial Traders (Companies):

Net Short Positions: 28%

Open Interest: 80,000 contracts

Non-Reportable Traders (Small Traders):

Net Long Positions: 20%

Open Interest: 40,000 contracts

COT Ratio: 1.9 (indicating a bullish trend)

🟠Sentimental Analysis

Institutional Sentiment: 58% bullish, 42% bearish

Retail Sentiment: 55% bullish, 45% bearish

Market Mood: The overall market mood is bullish, with a sentiment score of +25

🔴Positioning Analysis

Institutional Traders: Net long positions increased by 8% over the past week, indicating growing bullish sentiment

Retail Traders: Net long positions decreased by 3% over the past week, indicating decreasing bullish sentiment

Leverage: The average leverage used by traders has increased to 2.8, indicating growing confidence in the market

⚫Overall Outlook

The overall outlook for UK100 is bullish, driven by a combination of fundamental, technical, and sentimental factors. The expected growth in the UK economy, low interest rates, and bullish market sentiment are all supporting the bullish trend. However, investors should remain cautious of potential downside risks, including changes in global economic trends and unexpected regulatory developments.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

📌Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

UK100 - Trade IdeaHi all,

Here we have a strong Counter Trend setup, in my own opinion it looks to be very strong with no resting Liquidity sitting higher telling me price will want to chase for that sell side Imbalance.

It is a counter trend setup so its a high risk to high reward but could be worth the trade.

Ill be keeping my eyes on this for the close future to see how Price Action develops.

Good luck if you decide to follow this trade idea

Cheers

THE IMPORTANCE OF TREND FOLLOWINGMost people tend to not check the overall trend not knowing that could potential be a danger to their trades and account

If the overall trend is a downtrend(making lower lows and lower high)- you should look only for selling entries especially if you trade bigger time frames(M15 to upwards). However it's not that simple or everyone would be making millions of dollars lol.

when you check the overall trend you should make sure the swing lows and high are clear, strong and the bearish/bullish pressure(volatility) should also be strong and clear if one of these is missing

then it's best to stay away from the market or you'll become liquidity for other trades😂

so all in all, combine your Trend following with liquidity and market volatility.

Overlap resistance ahead?UK100 is rising towards the pivot which has been identified as an overlap resistance and could drop to the pullback support.

Pivot: 8,628.83

1st Support: 8,461.16

1st Resistance: 8,745.12

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

Bullish bounce off pullback support?UK100 has bounced off the pivot which is a pullback support and could rise to the 1st resistance which is also a pullback resistance.

Pivot: 8,538.25

1st Support: 8,442.68

1st Resistance: 8,743.14

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

Bearish drop?UK100 has reacted off the pivot which acts as an overlap resistance and could drop to the 1st support level which is a pullback support.

Pivot: 8,701.78

1st Support: 8,536.52

1st Resistance: 8,783.04

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

POTENTIAL SHORT TRADE SET UP FOR UK100Analysis: Utilizing chart patterns, highs & lows, and impulses & corrections, the focus is on identifying a continuation corrective structure following a breakout.

Entry: The price approached the previous upper zone of a HTF ascending structure with an ascending structure on the mid time frame (MTF), then plummeted from the swing high area signaling a bearish shift, and formed another bearish continuation-like pattern on the LTF. We shall be looking for an entry with a small bearish continuation structure here targeting the lower bound of the HTF ascending structure

Expectation: A downward move is anticipated.

⚠️ Reminder: Conduct your own analysis and implement proper risk management, as forex trading carries no guarantees. This is a high-risk endeavor, and past performance does not predict future outcomes. Trade responsibly!

UK100 about to drop again?good day traders, our past trades were a success and as you can see UK100 is repeating the same pattern again, meaning we are anticipating another drop, I won't explain much because it's simple and clear analysis that is self-explanatory. all I can say is wait for a candle rejection and enter

FTSE100 (UK100) The Week Ahead 10th March '25Sentiment: Neutral, Price action is consolidating in a tight trading range.

Resistance: Key Resistance is at 8760, followed by 8910 and 9000.

Support: Key support is at 8620 followed by 8536 and 9000.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

FTSE INTRADAY awaits BoE MPC The FTSE 100 index could see some volatility today as the Bank of England’s Monetary Policy Committee (MPC) meeting is set for 12:00 London time. The central bank is expected to keep the benchmark rate at 4.50%. Earlier today, UK jobs data showed the ILO Unemployment Rate remained steady at 4.4% for the three months to January.

The FTSE 100 index is currently exhibiting a neutral sentiment, as evidenced by the prevailing sideways consolidation. The primary focus remains on the key resistance level at 8745, which corresponds to the current intraday swing high. Alternatively the downside is supported at 8616. This levels are critical as they determine the next directional move of the index.

Key Support and Resistance Levels

Resistance Level 1: 8745

Resistance Level 2: 8770

Resistance Level 3: 8834 - 8910

Support Level 1: 8616

Support Level 2: 8505

Support Level 3: 8352

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

UK100 GOING UP?!Good day traders, my analysis shows that the price will head up but we need some few confirmations first before that

The previous trend was a bearish trend and price failed to create new lower lows and we had our Change of Character/Trend. Price broke above our CHoC giving us a New higher high which shows that buyers are more than sellers, causing price to head up

We broke above the New high and now the price is "Retracing" before it continues it's bullish movement, the best thing to do would be to wait for a bullish candlestick on the Zone(new high) before buying

FTSE INTRADAY capped by 8715The FTSE 100 index is currently exhibiting a neutral sentiment, as evidenced by the prevailing sideways consolidation. The primary focus remains on the key resistance level at 8715, which corresponds to the current intraday swing high. This level is critical as it determines the next directional move of the index.

From the current levels, an oversold rally could potentially emerge, leading to a retest of the 8715 resistance. A bearish rejection from this level would reinforce the downtrend, paving the way for a move towards the 8500 support. Further downside momentum could extend losses to the next support levels at 8440 and 8352 over a longer timeframe.

On the other hand, a confirmed breakout above 8715 on a daily closing basis would invalidate the bearish outlook. In such a scenario, the index is likely to experience renewed buying interest, targeting the next resistance at 8770, followed by a potential rally towards the 8834 and 8910 level.

Conclusion:

The overall sentiment for the FTSE 100 remains bearish unless a decisive breakout above the 8715 resistance occurs. Traders should monitor price action around this critical level for confirmation of either a continuation of the downtrend or a potential bullish reversal.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

FTSE100 The Week Ahead 17th March '25FTSE100 INTRADAY bullish & oversold, the key trading level is at 8520

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

FTSE INTRADAY bearish oversold bounce backThe FTSE 100 index is currently exhibiting a bearish sentiment, as evidenced by the prevailing downtrend. The primary focus remains on the key resistance level at 8638, which corresponds to the current intraday swing high and the falling resistance trendline. This level is critical as it determines the next directional move of the index.

From the current levels, an oversold rally could potentially emerge, leading to a retest of the 8638 resistance. A bearish rejection from this level would reinforce the downtrend, paving the way for a move towards the 8520 support. Further downside momentum could extend losses to the next support levels at 8476 and 8327 over a longer timeframe.

On the other hand, a confirmed breakout above 8638 on a daily closing basis would invalidate the bearish outlook. In such a scenario, the index is likely to experience renewed buying interest, targeting the next resistance at 8693, followed by a potential rally towards the 8760 level.

Conclusion:

The overall sentiment for the FTSE 100 remains bearish unless a decisive breakout above the 8638 resistance occurs. Traders should monitor price action around this critical level for confirmation of either a continuation of the downtrend or a potential bullish reversal.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.