CleanSpark (CLSK) Stock Price

9.01USDR

+0.15+1.69%

At close at Apr 25, 23:59 GMT

USD

No trades

Next report date

≈

May 7

Report period

Q2 2025

EPS estimate

−0.061 USD

Revenue estimate

189.40 M USD

0.18 USD

−145.78 M USD

378.97 M USD

272.23 M

About CleanSpark, Inc.

Sector

Industry

CEO

Zachary K. Bradford

Website

Headquarters

Henderson

Founded

1987

FIGI

BBG001MB89V6

CleanSpark, Inc. is a bitcoin mining technology company, which engages in the management of data centers. Its operations include College Park, Norcross, Washington, Sandersville, Dalton, and Massena. The company was founded by S. Matthew Schultz and Bryan Huber on October 15, 1987 and is headquartered in Henderson, NV.

−240%

−120%

0%

120%

240%

Q1 '24

Q2 '24

Q3 '24

Q4 '24

Q1 '25

−260.00 M

−130.00 M

0.00

130.00 M

260.00 M

Revenue

Net income

Net margin %

Revenue

COGS

Gross profit

Op expenses

Op income

Non-Op income/ expenses

Taxes & Other

Net income

−90.00 M

0.00

90.00 M

180.00 M

270.00 M

Revenue

COGS

Gross profit

Expenses & adjustments

Net income

0.00

70.00 M

140.00 M

210.00 M

280.00 M

Q1 '24

Q2 '24

Q3 '24

Q4 '24

Q1 '25

−300.00 M

0.00

300.00 M

600.00 M

900.00 M

Debt

Free cash flow

Cash & equivalents

No news here

Looks like there's nothing to report right now

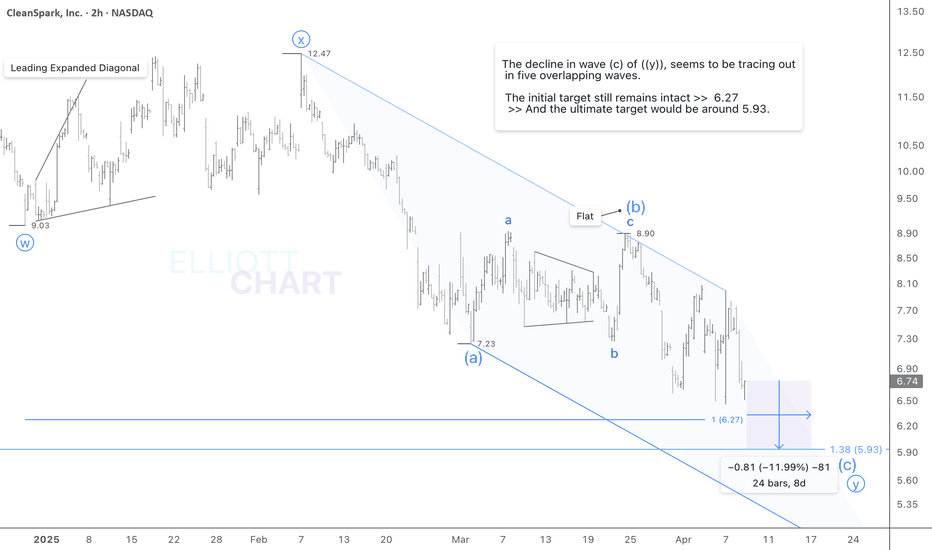

CLSK / 4h#CleanSpark has worked slightly higher in a couple of days, and its analysis in this frame has not changed so far. Over the next week, the current decline of wave y might trace out a three-wave sequence thoroughly like the prior subdivisions (w & x).

The initial target remains intact >> 6.27

>> An

CLSK / 4h#CleanSpark rising by 36% in three straight weeks and its wave structure (in a five-wave sequence) quite well would suggest that entire correction in Minor degree wave B could have ended at the early April low >> 6.46, which was very close to the anticipated Fib-target >> 6.27.

Technically, the t

Clean set up Bouncing of the lower trend line yet again, CleanSpark plans to sell mined Bitcoin each month and has secured a $200M credit line from Coinbase Prime as it shifts toward self-funding operations.

I'm a fan of more cash on hand giving the room to scale.

NLong

CLSK / 3h#CleanSpark has developed the price volatilities in overlapping waves since the late-March high (8.90), so all would be well considered as a three-wave sequence in , which its subdivisions of w and x should be over, and y has begun its way down.

Further decline of wave y (estimated >> 18%) lie

CLSK / 4h#CleanSpark has worked slightly higher (3.73%), so the countertrend rally in wave x would have remained in a very late stage.

The ultimate decline (estimated >> 28%) in wave y lies ahead

towards the anticipated Fib-targets and against the late-March high at 8.90.

The initial target remains in

$CLSK / 2hThe ongoing overlapping waves in NASDAQ:CLSK have revealed a three-wave sequence in both waves w and x so far. An ultimate decline in wave y may have started Wednesday towards the anticipated Fib-targets.

The initial target remains intact >> 6.27

>> And the ultimate target would be around 5.

$CLSK / 2hThe price volatilities in NASDAQ:CLSK have revealed overlapping waves which seem to have inclined towards the expected targets and might be framed in an ending diagonal as wave(c) of ((y)).

The Fib-expansion targets remain intact >> 6.27 >> 5.93

#CryptoStocks #CLSK #BTCMining #Bitcoin #BTC

$CLSK / 2hThe price volatility in NASDAQ:CLSK has revealed overlapping waves, which would incline to achieve new lows towards the expected targets that remain intact yet.

Hence, further decline lies ahead to trace out the ongoing wave (c) in a thorough five-wave sequence.

The Initial Target >> 6.27

The Ult

$CLSK / 4hThe price volatility in NASDAQ:CLSK last week revealed overlapping waves, which would be inclined to achieve new lows towards the expected targets that remain intact yet.

Hence, further decline should likely lie ahead to trace out the ongoing wave (c) in a thorough five-wave sequence.

The Initial

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

CLSK5962121

CleanSpark, Inc. 0.0% 15-JUN-2030Yield to maturity

−0.07%

Maturity date

Jun 15, 2030

See all CLSK bonds

Curated watchlists where CLSK is featured.

Frequently Asked Questions

The current price of CLSK is 9.01 USD — it has increased by 1.69% in the past 24 hours. Watch CleanSpark, Inc. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NASDAQ exchange CleanSpark, Inc. stocks are traded under the ticker CLSK.

CLSK stock has risen by 23.93% compared to the previous week, the month change is a 4.28% rise, over the last year CleanSpark, Inc. has showed a −51.61% decrease.

We've gathered analysts' opinions on CleanSpark, Inc. future price: according to them, CLSK price has a max estimate of 27.00 USD and a min estimate of 12.00 USD. Watch CLSK chart and read a more detailed CleanSpark, Inc. stock forecast: see what analysts think of CleanSpark, Inc. and suggest that you do with its stocks.

CLSK reached its all-time high on Sep 19, 2018 with the price of 150.10 USD, and its all-time low was 0.97 USD and was reached on Mar 17, 2020. View more price dynamics on CLSK chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

CLSK stock is 4.71% volatile and has beta coefficient of 2.14. Track CleanSpark, Inc. stock price on the chart and check out the list of the most volatile stocks — is CleanSpark, Inc. there?

Today CleanSpark, Inc. has the market capitalization of 2.53 B, it has increased by 0.13% over the last week.

Yes, you can track CleanSpark, Inc. financials in yearly and quarterly reports right on TradingView.

CleanSpark, Inc. is going to release the next earnings report on May 7, 2025. Keep track of upcoming events with our Earnings Calendar.

CLSK earnings for the last quarter are 0.83 USD per share, whereas the estimation was 0.37 USD resulting in a 123.97% surprise. The estimated earnings for the next quarter are −0.061 USD per share. See more details about CleanSpark, Inc. earnings.

CleanSpark, Inc. revenue for the last quarter amounts to 162.30 M USD, despite the estimated figure of 154.25 M USD. In the next quarter, revenue is expected to reach 189.40 M USD.

CLSK net income for the last quarter is 246.79 M USD, while the quarter before that showed −62.18 M USD of net income which accounts for 496.90% change. Track more CleanSpark, Inc. financial stats to get the full picture.

No, CLSK doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Apr 27, 2025, the company has 270 employees. See our rating of the largest employees — is CleanSpark, Inc. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. CleanSpark, Inc. EBITDA is 129.58 M USD, and current EBITDA margin is 25.16%. See more stats in CleanSpark, Inc. financial statements.

Like other stocks, CLSK shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade CleanSpark, Inc. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So CleanSpark, Inc. technincal analysis shows the buy rating today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating CleanSpark, Inc. stock shows the sell signal. See more of CleanSpark, Inc. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.