Cocoa Futures

10,171USD / TNED

+831+8.90%

At close at May 13, 11:52 GMT

USD / TNE

No trades

Contract highlights

No news here

Looks like there's nothing to report right now

Cocoa Explosion Loading? Specs & Hedgers Agree🔍 Fundamental Analysis – Commitment of Traders (COT)

The latest COT report, dated May 13, 2025, reveals a strong bullish accumulation signal, with a significant increase in long positions across all major trader categories.

Specifically, Non-Commercials (speculative traders such as hedge funds and

IShort

Cocoa's Future: Sweet Commodity or Bitter Harvest?The global cocoa market faces significant turbulence, driven by a complex interplay of environmental, political, and economic factors threatening price stability and future supply. Climate change presents a major challenge, with unpredictable weather patterns in West Africa increasing disease risk a

ILong

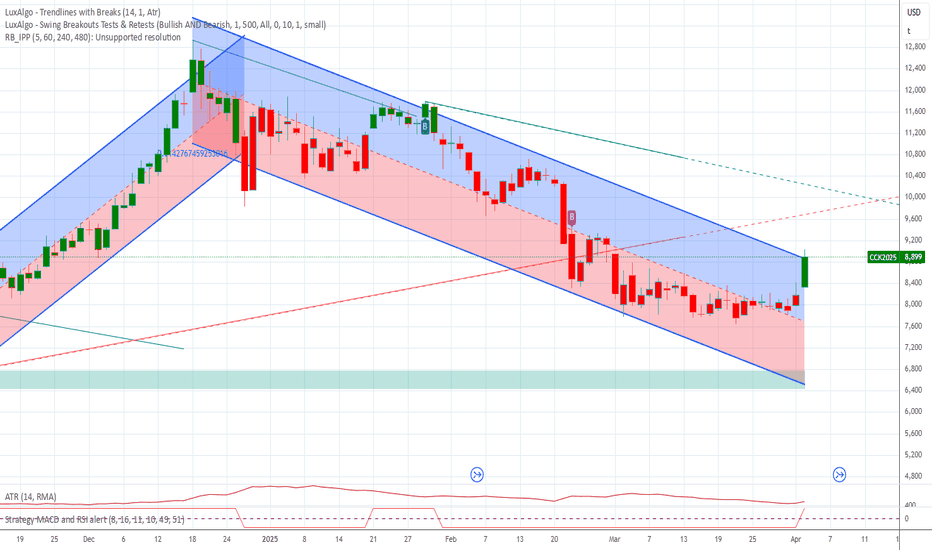

Cocoa futures swing idea There is some room for price to advance to 9.500 area for a nice swing. We'll see.

ILong

LONG FUTURE CACAO Hello everyone, today I’m sharing my analysis on cocoa futures, as I see an interesting opportunity for an upward move. Below, I’ll break down the reasons behind my bullish bias and my entry strategy. Let’s get into the details!

Why I’m Bullish on Cocoa Futures

Institutional and Retail Activity

My

ILong

Cocoa Short: Completed wave 2 (or B) rallyI've previously publish an idea for Cocoa long because of ending diagonal. But it should be clear to an EWer that the down move was a 5-wave structure and thus the long idea was a wave 2 or B idea. Now that we have completed 3-waves up for Cocoa, I think it's time that Cocoa resumes it's down move a

IShort

Cocao Futures LongCC1! is not net long on the regression break.

The roll long on this commodity is (-1.4%) per a month.

I am entering a EA for this pair with limited risk and controlled entry.

ILong

Cocoa Swing LongTrade idea based on supply and demand, intermarket analysis, COT positioning and cross market valuation. Following a structured approach with clear entry, risk management, and confluence factors.

ILong

Cocoa shortCocoa is clearly in a downtrend. Friday's candle is clearly a pin bar. For me it makes sense to go short with a target of 6000 USD. I would enter the trade if we break below the low of Friday's candlestick.

IShort

The Cocoa Code - Smart Money is Preparing for a Bullish MoveCocoa is setting up for a long trade upon a confirmed daily bullish trend change.

The fundamentals underlying this market suggest a bullish move of some significance is brewing, and would confirm if we see a daily bullish entry trigger.

Commercials at extreme in long positioning relative to last

See all ideas

A representation of what an asset is worth today and what the market thinks it will be worth in the future.

Displays a symbol's price movements over previous years to identify recurring trends.

CCN2025

Jul 2025DMarket closed

9,573USD / TNE−5.91%

CCU2025

Sep 2025DMarket closed

9,041USD / TNE−4.39%

CCZ2025

Dec 2025DMarket closed

8,434USD / TNE−3.70%

CCH2026

Mar 2026DMarket closed

7,916USD / TNE−3.16%

CCK2026

May 2026DMarket closed

7,741USD / TNE−3.08%

CCN2026

Jul 2026DMarket closed

7,641USD / TNE−2.87%

CCU2026

Sep 2026DMarket closed

7,609USD / TNE−1.90%

CCZ2026

Dec 2026DMarket closed

7,550USD / TNE−0.37%

CCH2027

Mar 2027DMarket closed

7,404USD / TNE+0.34%

CCK2027

May 2027DMarket closed

7,244USD / TNE+0.54%

See all CCK2025 contracts

Frequently Asked Questions

The nearest expiration date for Cocoa Futures is May 14, 2025.

Traders prefer to sell futures contracts when they've already made money on the investment, but still have plenty of time left before the expiration date. Thus, many consider it a good option to sell Cocoa Futures before May 14, 2025.