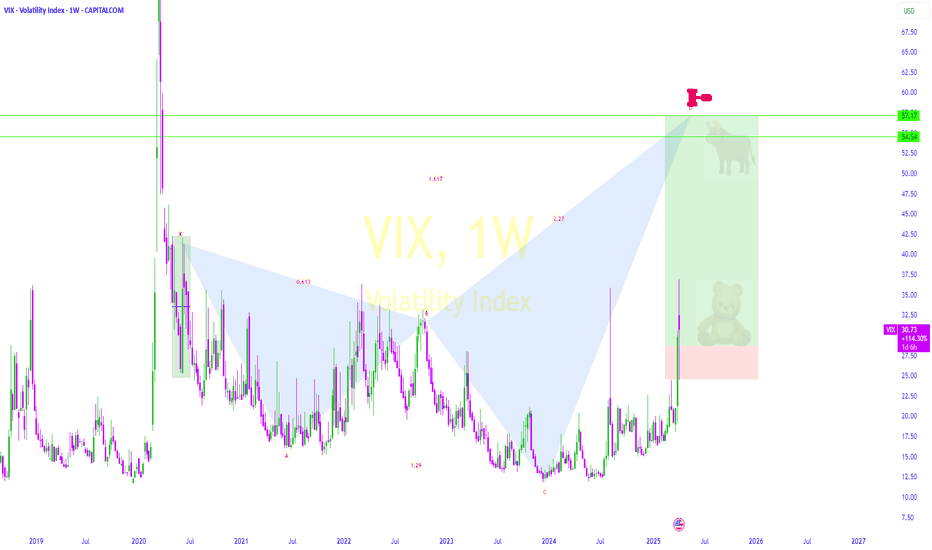

VIX, the paroxysm of fear is behind us The international equity market suffered a bearish shock between the beginning of February and the beginning of April, against the backdrop of the trade war. The trade war known as “reciprocal tariffs” initiated by the Trump Administration caused the MSCI World stock index to fall by over 20%.

Now,

Volatility S&P 500 Index

24.84POINTD

−1.63−6.16%

At close at Apr 25, 20:15 GMT

POINT

No trades

About Volatility S&P 500 Index

VIX is a trademarked ticker symbol for the CBOE Volatility Index, a popular measure of the implied volatility of S&P 500 index options; the VIX is calculated by the Chicago Board Options Exchange (CBOE). Often referred to as the fear index or the fear gauge, the VIX represents one measure of the market's expectation of stock market volatility over the next 30-day period.

No news here

Looks like there's nothing to report right now

TLong

VIX drop before the next ZOOM upWhat we experienced last week was absolutely insane in terms of volatility. The beauty of all of this is that it's still a trend and many of these spikes are quite predictable. We all knew about the days the tariffs that were going to hit, right? Why didn't you get into UVIX when I called this out d

TShort

VIX – “Liquidity Pool Bounce & Reversal Setup”🟢 VIX – “Liquidity Pool Bounce & Reversal Setup”

📅 Date: April 22, 2025

⏰ Multi-Timeframe Analysis (12h, 1D, 1h, 30m, 5m)

🔎 Global Context:

The Volatility Index (VIX) is reacting to a clear institutional liquidity zone (blue area) across multiple timeframes (12h, 1D, 1h), aligning with a mean re

VLong

VIX is a VIXjust having a little fun in a chat about how i chart the VIX. i say a VIX is a VIX. when we are spiking, we are spiking and we should become cautious if we don't know how to manage in that environment (intense bearish environment). this recent spike has proven that there are bullish moments that ca

Technical Analysis of VIX Dynamics:As we predicted, the small crab (retail traders) jumped from the ocean depths (high VIX zone) but failed to break the golden resistance at 29 due to panic and stress.

Now the mother crab (institutions) is preparing to surface. If successful, this could crush the VIX and dramatically shift mar

21.20 is the number to watchThis channel is not providing individualized trading or investment advice, nor is it a banking service, brokerage service, trading service, investment service or money management service.

VIX is readying for a golden shot#vix the volatility index is consolidating in falling megaphone channel for another impulsive wave. TVC:VIX had the 1st wave when trade wars begin (But i warned you 3 months ago with VIX chart) then 2nd wave of correction in progress and when 2nd wave consolidation is done, 3rd wave far more cruel

TLong

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

Volatility S&P 500 Index reached its highest quote on Oct 24, 2008 — 89.53 POINT. See more data on the Volatility S&P 500 Index chart.

The lowest ever quote of Volatility S&P 500 Index is 8.56 POINT. It was reached on Nov 24, 2017. See more data on the Volatility S&P 500 Index chart.

Volatility S&P 500 Index value has decreased by −19.32% in the past week, since last month it has shown a 44.17% increase, and over the year it's increased by 52.86%. Keep track of all changes on the Volatility S&P 500 Index chart.

Volatility S&P 500 Index is just a number that lets you track performance of the instruments comprising the index, so you can't invest in it directly. But you can buy Volatility S&P 500 Index futures or funds or invest in its components.