Predictions and analysis

Base on the movement of BTCUSDT it's not bullish, not for now. In my opinion waiting for the right moment is what we should do in this time, I think after two or three days after HALVING, the market will choose its path. NO HARD FEELINGS FOR +2 OR +3%. . .

Just an idea, you can see Xrp went for $0.1665 to $0.5000 Then snapped back to $0.0085 before ripping up to $3.50 Always watching this coin because we all see it’s huge pontential, with BTC making a pattern to drop and black rock trying to control the market, I imagine we could see a sharp push up to collect, followed by a heavy retracement down before take...

Watching Aleph if we see a break above $0.1402 —- $0.1472 We could see a nice rapid push to the purple line around $0.2000 —$0.2017 Violent but possible currently up 34% on the daily but wait for a good confirmation to enter your trade looking similar to how flare took off and is at nearly 100% liquidation from entry. This will be quick pump and dump stuff. Good...

Home Depot (HD) exhibits several bullish indicators that suggest a potential upward trajectory. Firstly, the company consistently demonstrates robust financial performance, with strong revenue growth driven by increased consumer spending on home improvement. Additionally, HD's market dominance, extensive store network, and successful online presence position it...

Here i see a head and shoulders pattern forming,juat need to be patient and wait for the opportunity,this week and last i personally entered just three trades,trading four pairs for now its how much i can handle,working my 8 hour regular job.

As you all know {for those following this channel btw}, i have been trading off of the price movements of EURCAD since January and it has been swell so far so good. The amazing part of it all is that price has been building up to form a pattern we all know and love "THE HEAD AND SHOULDERS PATTERN" and it's super valid because it's actually very clear in the D1...

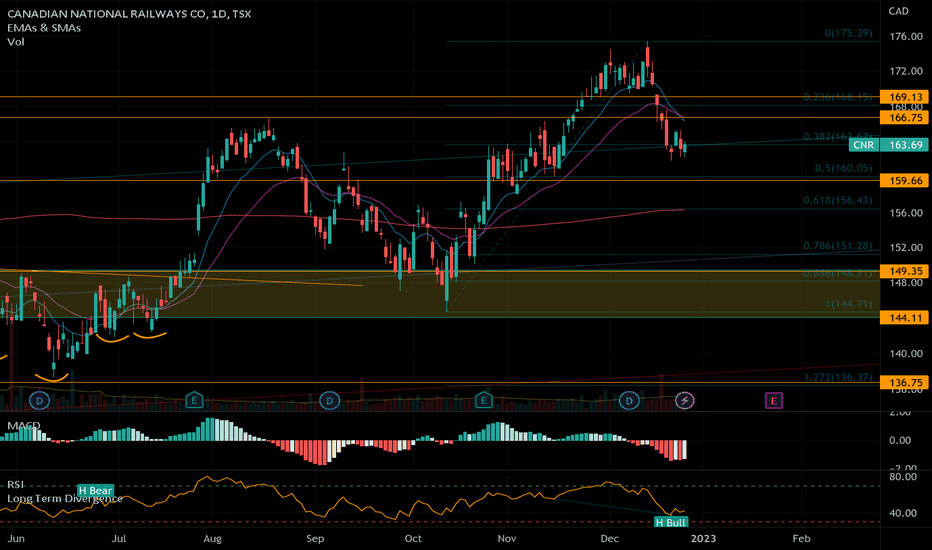

Looking to take a shot Longing CNR at the 50% Retracement, also a support level, waiting to see how the next few days go. Coming straight down to the 50% Retracement would put RSIs on lower time frames in a more favorable position as well

Hello Team, Currently Bitcoin is between a support & resistance level. For us we will not be placing trades within this range. - If the price breaks above the resistance we will look for a buying opportunity. - If the price breaks below the support we will look for a selling opportunity. Patience is key, let price action tell us the answer.

USDCAD good point to look after big short impulse usdcad searching for correction and confirmed a pattern so wait and enjoy winning

OANDA:GBPUSD GBPUSD Neutral bias Status: Open short position and waiting for breakeven confirmation What do I see? - VIX could go bullish as it's on its major Daily low, resulting in USDCHF going bullish. - Low volatility as the market waits for Durable Goods Orders MoM, New Home Sales, and FOMC Minutes report. - Could result in a sideways market in the long...

30 years US Dollar Future could be going back to its 2008 level. Potential probability exists to see it going even lower. Market price have failed to break its 2020 down trending resistance. The potential historical resistance, illustrated with the horizontal upper line, shows that the market have tried to go in the long direction but have failed several...

OANDA:GBPUSD GBPUSD Neutral bias. Status: Waiting for confirmation What do I see? - Traders are waiting for Building Permits Prel and Housing Starts Report. As the market is aspected to go sideways, both of those reports could impact significantly our next decision regarding the direction of the market. - The market is biased both ways, creating a liquidity...

BTC has broken down, now the best option is to wait It has fallen so much so far, so my next operation is to wait for the opportunity to go long. The chance is that the macd bottom diverges in more than 1 hour, or it is a signal at the bottom of the ultra-long lower shadow line. Strong support is near 20800, look at a support line at the bottom of my...

Hello traders! I'm waiting for the price to reach the marked orange zones where I will look for a position to buy, if I get a signal, if the price goes below the dark orange zone at the end of the day, then I will start looking for short-term shorts next week. I personally prefer setting up multiple TPs , here's an explanation: 1) 1:1 allows you to take a 50%...

Hi friends. we are in a range area between two divergent lines that i show on my chart. if we break this pattern down we see lower levels 1723 and if we loss this level too we see 1690. but if this pattern breakout up this means maybe we have a Retest to 1785 level and after that maybe again falling. this levels that i illustrate have an overlap with upper and...

Hey traders, it's Friday and we probably won't get into the analyzed zone this week, but at least we know what to expect! Most successful trades are based on waiting. I personally prefer setting up multiple TPs , here's an explanation: 1) 1:1 allows you to take a 50% position and thus secure a balance against loss in case the market turns 2) 2-5 :1 means profit...

Daily: Down trend, target price ~5.80 (5.90). The pair is in the channel after descending, no bullish signs from higher TF. H4: After fast descending from the 9.00 the price stopped at local support (~7.9). Usually after fast movement the price need some time for the rest, new traders will come in. Everyone see the levels, everyone is putting their stops and...