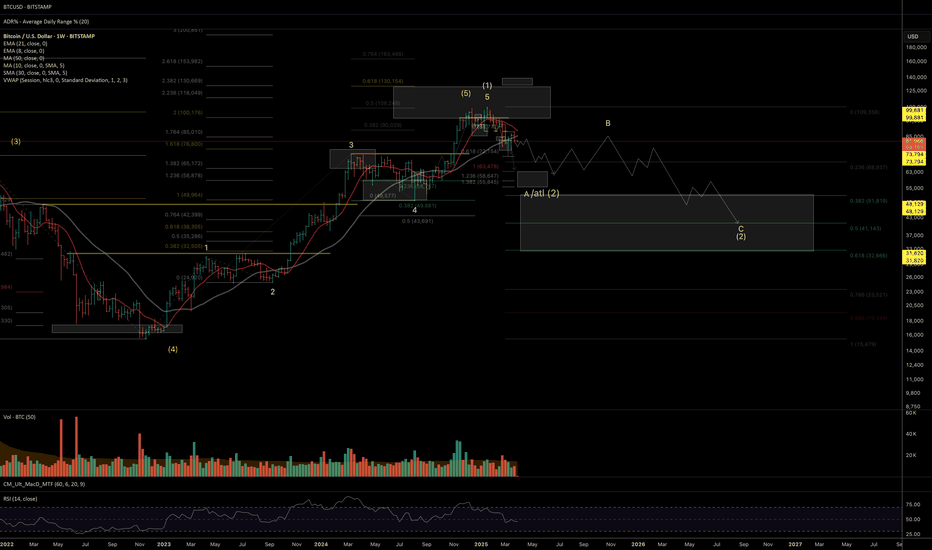

The price has now reached the upper boundary of the ideal macro support zone for a complex and rare corrective structure (running flat), between 11–8.5. As long as the price holds above April’s low, my operative scenario assumes that a new multi-year uptrend (wave (3)) has already started. Key resistance zones to watch ahead: 85–121 (first major resistance)...

The price has reached the target macro support zone for the formation of a long-term bottom. As long as the price stays above the April 7th lows, my main scenario is that the macro correction (wave (2)) has ended and a new multi-year growth cycle has begun. Weekly Projection: Thank you for your attention and I wish you successful trading...

Price has reached ideal macro support zone: 90-70 within proper proportion and structure for at least a first wave correction to be finished. Weekly As long as price is holding above this week lows, odds to me are moving towards continuation of the uptrend in coming weeks (and even years). 1h timeframe: Thank you for attention and best of luck to your trading!

Price has reached a key mid-term resistance zone (29-32) for a bounce since Apr bottom. As long as price remains below the 32 (with max. extension to 34) resistance area, I continue to favor the scenario of another leg lower unfolding in the coming weeks. Should price break and hold above 32–34, the current trend structure would require...

Price has reached a meaningful resistance area near the March highs, which may trigger renewed selling pressure. If confirmed, this could open the path toward a deeper move into the macro support zone around 60–50. Until price is closing bellow 100, my operative scenario is one more wave down to a macro support. Thanks for your attention and best of luck...

Price has now reached an ideal resistance zone, aligning with the 2024 summer top, where a bounce (wave B) is to complete itself. As long as price remains below the 425 level, I see the odds favoring another leg lower, targeting the macro support zone around 300–270. Thanks for your attention and best of luck with your trading!

Price reached and important resistance levels to start forming the top of upward trend since 2022 bottom. In precious metals fifth waves tend to extend beyond standard fib levels. So if price moves beyond 300, the door opens for a move to 308-330 resistance zone. Wishing you successful trading and investing decision and thank you for attention!

Price is approaching a key macro support zone. However, as long as it remains below the $148 level, I cannot rule out the possibility of one more corrective leg toward the $76–$55 range before a medium-term bottom is established and a potential resumption of the broader uptrend begins. A breakout and sustained close above the $148 level would serve as the...

Until the price closes below 100, the current trend structure suggests a one more leg down toward the 76–70 macro support zone. However, if the price successfully clears the 100 resistance level - rising and closing above it with strong volume - the odds will shift in favor of a correction ending and the potential start of a new uptrend toward the 210–270...

As price holds below $344, odds favor a continuation lower to retest February lows, with later potential bounce and one more push to macro-support levels: 160/150-120 (with a potential extension to 105) (see. recent idea on BTC price structure) If BTC and broad market indexes show signs of stabilization and short-term strength over the coming weeks with MSTR...

Price reached the top of the macro support: 56-27. The correction from Nov'21 top has a picture perfect three-wave structure that has reached area of an ideal extension to finish itself (60-44 support). Although, within the context of todays market uncertainty, recovery from this support zone, might still be a larger bounce before one more leg-down deeper...

As long as March lows hold, there remains a technical possibility for one more wave up toward the 130K resistance zone. However, given the corrective three-wave structure of the recovery (rather than an impulsive five-wave move), I am now leaning toward the mid-term top being in place at January highs. If price remains below last week’s high, my operative...

Until price is holding above 13th Jan lows, my operative scenario is continuation of the upside momentum towards 420-450 resistance zone. Moving and holding above 450 level increases the probability of a continuation move towards higher resistance levels at 590+. Otherwise, until price holds bellow 450, there are significant odds of deeper correction in the...

Price has approached the upper border of the mid-term resistance zone: 598-612. Until price closes bellow 612, I am preparing for the start of a correction to mid-term support: 564-540. If price moves confidently above 612, than next resistance target is at 635 level. The macro-structure of the uptrend from 2022 lows is well intact until price holds above...

Chart on the daily looks like being in no-mans is about to decide of its further direction. I have two main alternatives: 1. If price moves above Jan 24th highs the road is opened to following resistance zone: 20-25, 28-33 and a push towards ideal macro-resistance target at 37-45 levels; 2. If price break down bellow Feb 3rd lows, odds are moving in...

Meta is approaching important resistance zone both in terms of macro (from 2022 lows) and mid-term (since Apr 2024 lows): 700-760 level. Until price is bellow 760 level, my operative scenario is to prepare for at least mid-term topping action with following unfold of larger correction. Macro support levels for this potential correction are at 520-420. From...

The swing long set-up from Dec pullback is about to fully realize its potential From my Dec chart archive: pbs.twimg.com And Jan update: pbs.twimg.com when I wrote: "It wouldn't not surprise me to see price pulling back bellow Oct's highs slightly and finding support on rising 8/21 emas before continuing its advance. Until price is above 21 ema, next...

If price is to hold above 209-198 area of support, next resistance zones are: 287-303 and 320-330-360. Macro trend structure also assumes higher targets for the uptrend since 2022 bottom (Monthly): Thank you for your attention!

![NKE: Macro structure [Monthly time frame] NKE: NKE: Macro structure [Monthly time frame]](https://s3.tradingview.com/z/ZZQv6C7J_mid.png)