Trade criteria met, going for a short. Looking for more downside.

Going for shorts on USD/JPY. Trade criteria met, will see how this plays out.

All trade criteria has now been met, going for shorts. Not the highest quality setup so half risk but still valid.

Waiting on the short idea for AUD/NZD, awaiting trade criteria to be met and then I will enter with confirmation.

Idea for a long if we break and retest this zone - risk-reward is a set 1:3

High risk fakeout sell setup. Against the 50EMA (Which its reacting to on the 1HR now) so it's high risk. Also against the overall trend.

Long idea from a 3 confluence setup: 1 - Trendline 3rd touch 2 - Break and retest of structure 3 - Fib level confluence Entry on the wick after a bullish engulfing was formed on the lower time frames.

Been waiting on this trade since sunday. Looking for more downside after we broke structure and pulled back.

This is a long idea, the daily has rejected a double bottom liquidity zone, expecting the pair to push higher. Got in on an impulse and correction with a 1HR break and retest entry. Targeting the -0.27.

Looking at the daily I see a lot of potentials for longs, along with the strength of the other EUR pairs, I think that this could be a safe trade.

Based off the poor fundamentals for the AUD followed by a break of structure and a valid minor supply zone to hopefully carry on the trend.

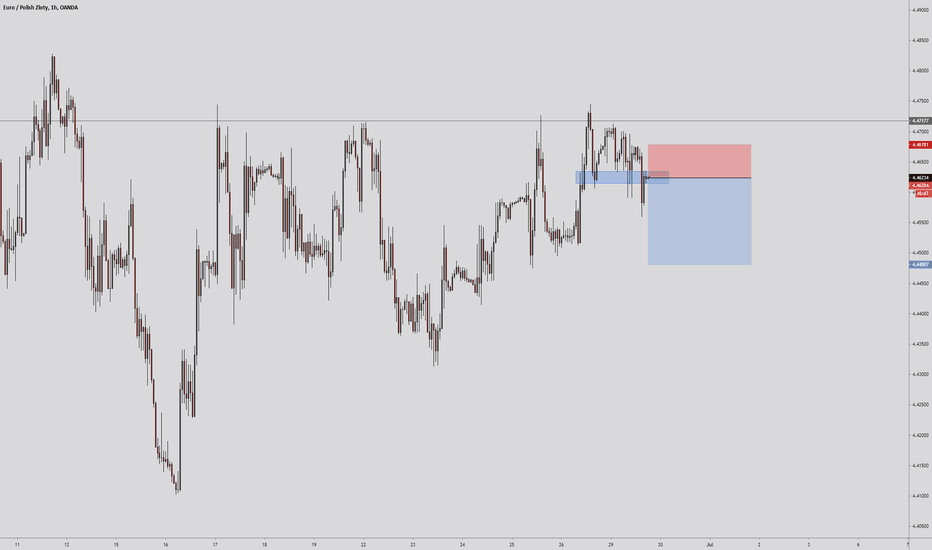

- Fundamentally the EUR has been very weak with some very poor changes to the overall data releases. Whilst the USD is the same, the USD could be used as the safe heaven. - Technically we have come into a valid minor supply zone after breaking structure and once my rules were met, I entered a short position.

- Fundamentally, the CAD is not looking very good, the GDP growth rate is down to -2.1 and all the other indicators are generally looking very bad for the CAD. - Technically, we were trapped in a range and on the 4HR new demand was created when a minor trend line was broken - Once we returned to this new demand zone, the 1HR created a nice ascending structure and...

If we can get a break and close above this trend line to show a loss of momentum we can then be looking for buys.