UK100 trade ideas

➖ Back in May 2018 the UKX produced a peak that led to a major crash a few years later, this was the All-Time High at the time. ➖ The ATH came in May 2018 followed by a long-term lower high January 2020. ➖ The lower high January 2020 signaled the start of the biggest corrective crash since 2008. We have a similar situation when it comes to price action and chart...

uk100 /USDT is Going to get a good setup for SHORT POSITION you can get this position with 0.2 LOT Good Luck & dont forget to set SL & TP

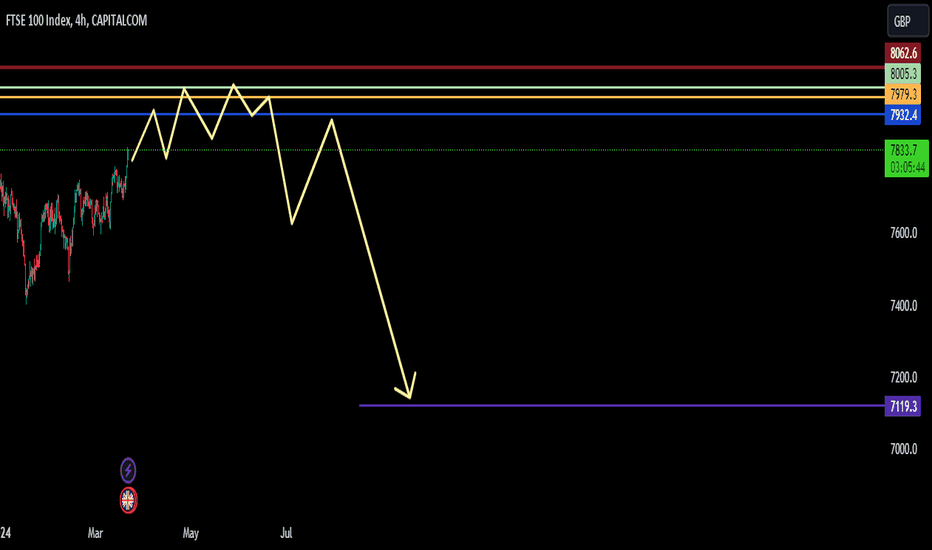

FTSE broke its support after what seems like a distribution. Should at least go down to major support for a major correction that is pending

@ price 7959.7 it is where I'm targeting to place a short, coz we are going to have a third touch at that highs trendlins & point 7959.7 when changing the candle sticks to ( Bars). You'll see that's where we have more opens buys at the very same zone.

Please pay special attention to the very accurate trend, and colored levels, red level as SL. Be careful BEST MT

uk100gbp 11111111111111111111111111111111 1111111111111111111111111111111111 111111111111111111111111111111111 111111111111111111111111111111111111

UK Inflation readings just came in and the UK govt is raving about it. Well needed gratification is in order due to the current dire political situation (we won't talk politics).. Their promise was to halve inflation and their positive sentiment/rhetoric along with US news yesterday is creating bullish atmosphere within the UK main Stock Market, the FTSE 100. I...

Having broken through long-term resistance and come within touching distance of the February 2023 highs, the FTSE took a pause for breath last week pulling back from recent highs. Pullbacks provide excellent opportunities for traders to position themselves within established trends at attractive levels of risk/reward, and the FTSE’s recent pullback has put trend...

As described before one of the worst index's to have been exposed to for decades WHILST during rampant #UK inflation The FTSE did nothing to help you out. Yet here we are about to see it get sent to 5 figures.

As I see it, as long as we stay above 7600-7700 a pump to 8k is a lot more likely as there's evidently buyers in the market keeping the FTSE floating, where as a break below will send this south (7400 or lower).

Although UK-100 Index Is Near All-time Highs, UK Economy Slips into Recession Technically, a national economic recession is defined as two consecutive quarters of contraction, and yesterday's Office for National Statistics data confirmed that this has happened — UK GDP fell in the third and fourth quarters of 2023 by 0.1% and 0.3% respectively. The Guardian...

This chart is a clear display of how markets work in simple terms. The fact is, your job is to look for repetition. Repetition directly correlates to probability, as it is your bread and butter for understanding what is next, That is also, simply, the point of price action. So when something happens so many times.. Do not be surprised if it happens again. And...

going long after the the end of the pullback came to an end the v formation was tested and held

Earlier this month, we discussed subtle cues indicating the FTSE 100's readiness to break out. Fast forward three weeks, and the index has decisively broken free from its long-term range, surging over 150 points post the US Federal Reserve's reaffirmation of its rate-cut plans. FTSE 100 Daily Candle Chart Past performance is not a reliable indicator of...

An overview of all the pairs I am looking at for this trading week. Full breakdown in the video with analysis and explanations of what I will be waiting for before executing in the markets.

A BOLD prediction --- possibly to some people But I stand by this chart as a roadmap where I see #UK equities outperforming against the cash cow that has been UK #Housing The how's and what's and why's are unimportant But the key thing is for younger people struggling to get into UK housing Investing in #Stocks #Technology Innovation #AI and #crypto will...

UK-100 is on the verge of Symetrical triangle breakout. We will buy it on the breakout confirmation and targets last high.Our stops wil be last Lower High.