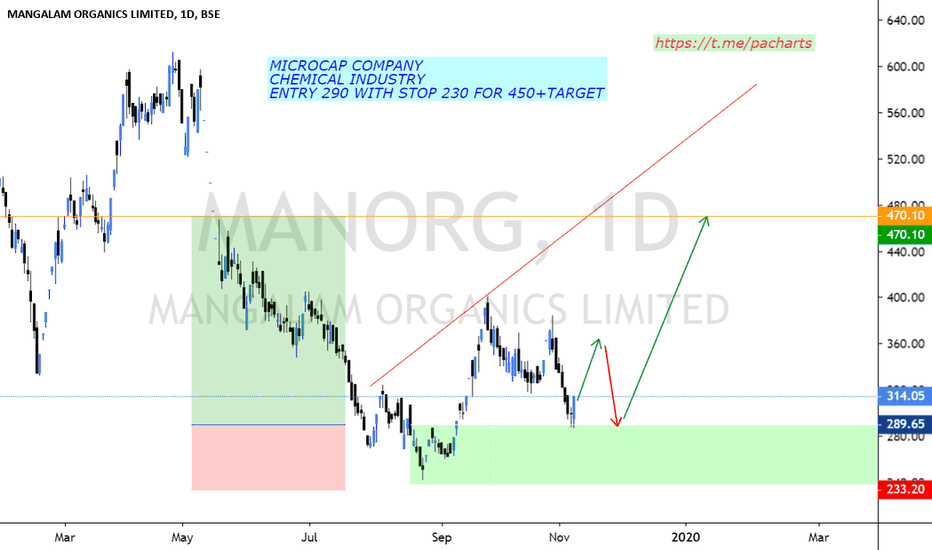

Mangalam organic looks good for 450Already made a botom breakout

Now tested 10ema support

It bounces from 10ema

Target would be 450

Stop 400

Risk reward 1:2

Swing trade..15 days period

Mangalam Organics Limited (MOL) are Prime Manufacturers of Camphor, Resin and Sodium Acetate. The management has over 50 years of experience in the pi

2.80INR

−272.25 MINR

4.93 BINR

2.79 M

About MANGALAM ORGANICS LIMITED

Sector

CEO

Sanjay Bhardwaj

Headquarters

Mumbai

Website

Employees (FY)

294

Founded

1946

ISIN

INE370D01013

FIGI

BBG000C1W1L2

Mangalam Organics Ltd. engages in the manufacturing of chemicals. Its products include resin and terpene, which offers camphor, dipentene, gum resin and sodium acetate. The company was founded by Ramgopal M. Dujodwala in 1946 and is headquartered in Mumbai, India.

Breakout Looking StrongBreakout is looking really good. I'm dibbling in here with a few shares. Will add more in the coming days.

Use 700 to 695 as stop loss.

Target 1 : 763

Target 2 : 808

Target 3: 850+ if the next quarter results turn out to be good. A very high chance given sep is usually its best quarter.

If the p

See all ideas

Trade directly on the supercharts through our supported, fully-verified and user-reviewed brokers.

Frequently Asked Questions

The current price of MANORG is 307.65 INR — it has decreased by 1.27% in the past 24 hours.

Depending on the exchange, the stock ticker may vary. For instance, on BSE exchange MANGALAM ORGANICS LIMITED stocks are traded under the ticker MANORG.

MANGALAM ORGANICS LIMITED is going to release the next earnings report on May 24, 2024. Keep track of upcoming events with our Earnings Calendar.

MANORG stock is 7.81% volatile and has beta coefficient of 0.79. Check out the list of the most volatile stocks — is MANGALAM ORGANICS LIMITED there?

Yes, you can track MANGALAM ORGANICS LIMITED financials in yearly and quarterly reports right on TradingView.

MANORG stock has fallen by 4.08% compared to the previous week, the month change is a 1.87% rise, over the last year MANGALAM ORGANICS LIMITED has showed a 39.95% decrease.

MANORG net income for the last quarter is 8.99 M INR, while the quarter before that showed 6.31 M INR of net income which accounts for 42.51% change. Track more MANGALAM ORGANICS LIMITED financial stats to get the full picture.

Today MANGALAM ORGANICS LIMITED has the market capitalization of 2.67 B, it has increased by 3.52% over the last week.

Like other stocks, MANORG shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade MANGALAM ORGANICS LIMITED stock right from TradingView charts — choose your broker and connect to your account.

As of Apr 18, 2024, the company has 294.00 employees. See our rating of the largest employees — is MANGALAM ORGANICS LIMITED on this list?

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So MANGALAM ORGANICS LIMITED technincal analysis shows the sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating MANGALAM ORGANICS LIMITED stock shows the sell signal. See more of MANGALAM ORGANICS LIMITED technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. MANGALAM ORGANICS LIMITED EBITDA is 387.90 M INR, and current EBITDA margin is −0.05%. See more stats in MANGALAM ORGANICS LIMITED financial statements.