544.21MXN

78.88 BMXN

1.19 TMXN

142.35 M

About ZURICH INSURANCE GROUP AG

Sector

Industry

CEO

Mario Greco

Website

Headquarters

Zurich

Employees (FY)

60 K

Founded

1872

ISIN

CH0011075394

FIGI

BBG00N2Y6V61

Zurich Insurance Group AG is a holding company, which engages in the provision of insurance products and related services. It operates through the following segments: Property and Casualty Regions, Life Regions, Farmers, Group Functions and Operations, and Non-Core Businesses. The Property and Casualty Regions segment provides motor, home, and commercial products and services for individuals, as well as small and large businesses on both a local and global basis. The Life Regions segment includes comprehensive range of life and health insurance products on both an individual and a group basis including annuities, endowment and term insurance, unit-linked and investment-oriented products, as well as full private health, supplemental health, and long-term care insurance. The Farmers segment focuses on non-claims administrative and management services to the Farmers Exchanges, which are owned by policyholders. The Group Functions and Operations segment is involved in group’s holding and financing and headquarters activities. The Non-Core Businesses segment offers insurance and reinsurance businesses. The company was founded in 1872 and is headquartered in Zurich, Switzerland.

$ZURVY - Growing stock$ZURVY - Zurich Insurance Group AG is a holding company that provides insurance products and related services.

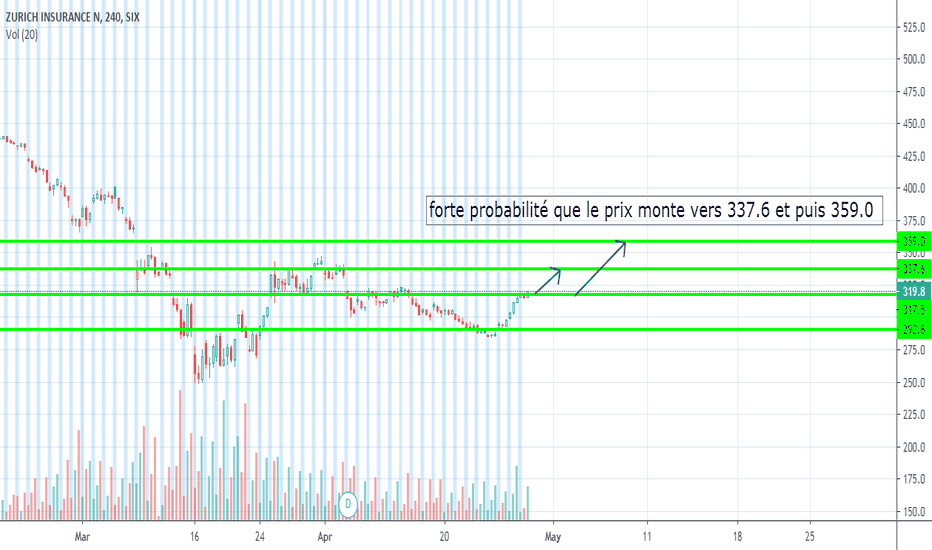

What's attractive about the schedule is.

1. Being close to ATH,

2. Moves in a rising channel

3. Trades above the 30W EMA

4. Last 2 weeks the volume is significantly higher than the average

See all ideas

Trade directly on the supercharts through our supported, fully-verified and user-reviewed brokers.

Frequently Asked Questions

The current price of ZURN/N is 9209.71 MXN — it has increased by 0.07% in the past 24 hours.

Depending on the exchange, the stock ticker may vary. For instance, on BMV exchange ZURICH INSURANCE GROUP AG stocks are traded under the ticker ZURN/N.

ZURICH INSURANCE GROUP AG is going to release the next earnings report on Aug 8, 2024. Keep track of upcoming events with our Earnings Calendar.

ZURN/N stock is 0.07% volatile and has beta coefficient of 0.93. Check out the list of the most volatile stocks — is ZURICH INSURANCE GROUP AG there?

One year price forecast for ZURICH INSURANCE GROUP AG has a max estimate of 10325.82 MXN and a min estimate of 7128.33 MXN.

ZURN/N earnings for the last quarter are 290.71 MXN whereas the estimation was 398.60 MXN which accounts for −27.07% surprise. Estimated earnings for the next quarter are 310.67 MXN. See more details about ZURICH INSURANCE GROUP AG earnings.

ZURICH INSURANCE GROUP AG revenue for the last quarter amounts to 574.23 B MXN despite the estimated figure of 390.90 B MXN. In the next quarter revenue is expected to reach 575.57 B MXN.

Yes, you can track ZURICH INSURANCE GROUP AG financials in yearly and quarterly reports right on TradingView.

ZURN/N net income for the last quarter is 33.20 B MXN, while the quarter before that showed 43.50 B MXN of net income which accounts for −23.68% change. Track more ZURICH INSURANCE GROUP AG financial stats to get the full picture.

Today ZURICH INSURANCE GROUP AG has the market capitalization of 1.19 T, it has decreased by 1.67% over the last week.

Yes, ZURN/N dividends are paid annually. The last dividend per share was 473.45 MXN. As of today, Dividend Yield (TTM)% is 5.38%. Tracking ZURICH INSURANCE GROUP AG dividends might help you take more informed decisions.

ZURICH INSURANCE GROUP AG dividend yield was 5.91% in 2023, and payout ratio reached 96.59%. The year before the numbers were 5.43% and 94.10% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

Like other stocks, ZURN/N shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade ZURICH INSURANCE GROUP AG stock right from TradingView charts — choose your broker and connect to your account.

As of Apr 18, 2024, the company has 60.00 K employees. See our rating of the largest employees — is ZURICH INSURANCE GROUP AG on this list?

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So ZURICH INSURANCE GROUP AG technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating ZURICH INSURANCE GROUP AG stock shows the strong buy signal. See more of ZURICH INSURANCE GROUP AG technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.

We've gathered analysts' opinions on ZURICH INSURANCE GROUP AG future price: according to them, ZURN/N price has a max estimate of 10325.82 MXN and a min estimate of 7128.33 MXN. Read a more detailed ZURICH INSURANCE GROUP AG forecast: see what analysts think of ZURICH INSURANCE GROUP AG and suggest that you do with its stocks.