Indicators, Strategies and Libraries

█ OVERVIEW This indicator was intended as educational purpose only based on Harmonic Pattern Table (Source Code) . Some user have different ratios in mind, thus I add input to allow user to change those ratios. █ CREDITS Scott M Carney, Trading Volume 3: Reaction vs. Reversal █ CREDITS 1. List Harmonic Patterns. 2. Font size small for mobile app and font...

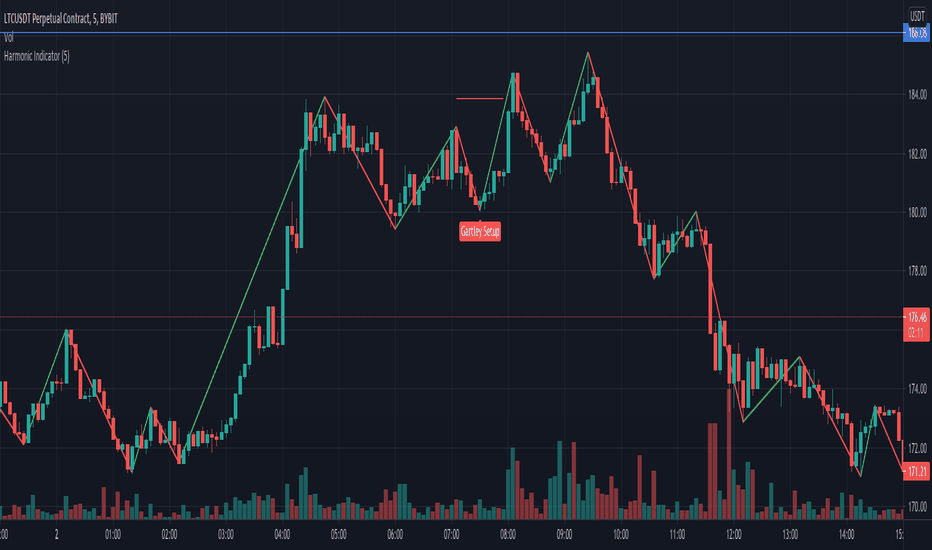

Gartley

The first target would be the 382 retracement of AD and the second target the 618 retracement of AD. A common stop level would be behind the X-point. Conservative traders may look for additional confirmation. Gartley Patterns can be bearish and bullish. TradingView has a smart XABCD Pattern drawing tool that allows users to visually identify 5-point reversal structures on a chart.

█ OVERVIEW This table indicator was intended as helper / reference for using XABCD Pattern drawing tool. The values shown in table was based on Harmonic Trading Volume 3: Reaction vs. Reversal written by Scott M Carney. Code upgrade from Harmonic Pattern Table (Source Code) and based on latest User-Defined Type (UDT) . As a result, code appeared more...

This indicator finds all of the gartley and cypher patterns on anychart and personally I have been using them profitably with BTC, ETH, and LTC. It includes entry points for both patterns but not TP levels, that is up to you to do research on. In version 2 I am working on this, if any of you can help me with that, it would be appreciated. Goodluck!